Costa Rican real estate is catching the eye of expats and global investors like never before, with foreign buyers now accounting for over 30 percent of all property transactions in key regions. Most expect palm trees and profit, but hidden financial risks can flip dreams into dollar drains overnight. What surprises many is that it’s not the local property prices that trip up investors the most, but rather the currency swings, steep loan requirements, and tangled legal paperwork that can throw even seasoned buyers off balance.

Table of Contents

- Understanding Real Estate Loan Risks In Costa Rica

- Market And Currency Risks For Foreign Investors

- How Loan Terms Impact Passive Income Potential

- Smart Risk Management Strategies For Property Owners

Quick Summary

| Takeaway | Explanation |

|---|---|

| Currency Exchange Risks | Foreign investors must manage significant currency exchange risks in Costa Rica, as fluctuations in the Costa Rican colón can dramatically affect loan affordability and investment returns. |

| Legal Complexities | Investors need to navigate intricate legal and documentation challenges, including property title verification and potential historical discrepancies, requiring comprehensive legal representation. |

| Loan Terms Affect Income | Understanding loan duration and interest rates is crucial, as these factors directly influence cash flow and passive income potential from real estate investments. |

| Diversification Strategy | To mitigate risks, property owners should diversify their portfolios across different property types and geographical locations within Costa Rica, which helps reduce exposure to localized market fluctuations. |

| Proactive Risk Management | Developing a strategic framework for risk management, including financial protection measures and continuous legal due diligence, is essential for sustaining real estate investments in the dynamic Costa Rican market. |

Understanding Real Estate Loan Risks in Costa Rica

Real estate loan risks in Costa Rica present a complex landscape for expats and investors seeking property investments in 2025. The unique financial environment demands strategic understanding and careful navigation to mitigate potential financial challenges.

Currency and Financing Complexities

Navigating the real estate loan market in Costa Rica requires an intricate understanding of local financial dynamics. Foreign investors frequently encounter significant currency exchange risks that can dramatically impact loan affordability. The Costa Rican colón experiences notable volatility, which means loan repayments can fluctuate substantially based on exchange rate movements. Investors must carefully assess their income streams and potential currency conversion costs.

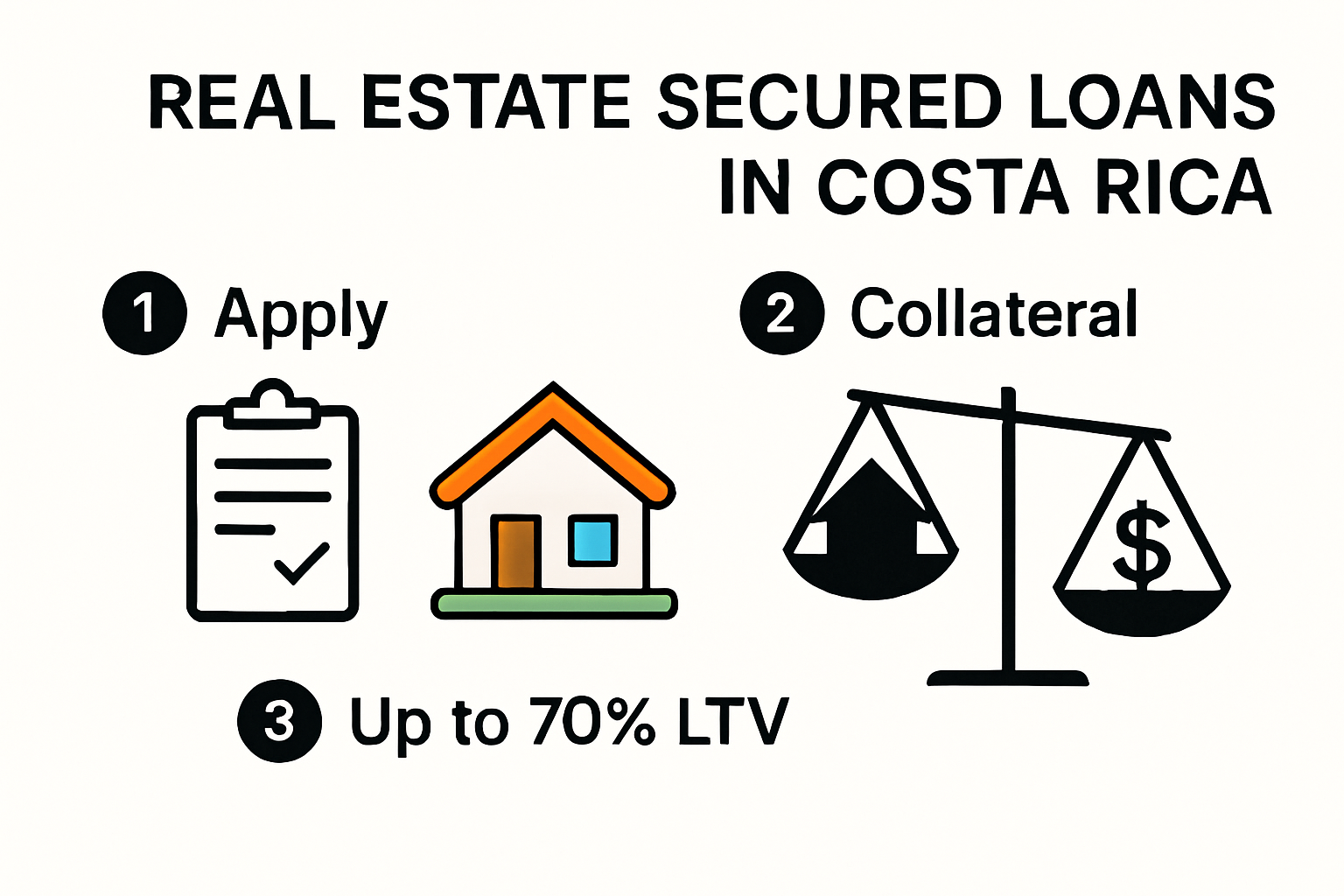

Interest rates for foreign investors typically range between 7% and 12%, substantially higher than rates in many developed markets. These elevated rates reflect the perceived higher risk associated with lending to non-resident borrowers. Banks and private lenders often implement stringent requirements, including substantial down payments ranging from 35% to 50% of the property’s total value.

Legal and Documentation Challenges

Legal complexities represent another critical risk factor for real estate loans in Costa Rica. Foreign investors must contend with intricate documentation processes that differ significantly from their home countries. Property titles can involve complex historical records, and potential unresolved boundary disputes or prescriptive easements might complicate loan approvals.

Notarial processes in Costa Rica require meticulous attention. Investors need comprehensive legal representation to verify property ownership, confirm clear title status, and navigate potential registration challenges. Some investors have encountered scenarios where property documentation contained historical inconsistencies or unclear ownership transfers.

Risk Mitigation Strategies

Successful real estate loan management in Costa Rica demands proactive risk mitigation strategies. Investors should consider exploring secure lending options that provide transparent terms and comprehensive property evaluations. Working with local financial experts who understand both international investment dynamics and Costa Rican regulatory frameworks becomes crucial.

Key risk management approaches include:

- Comprehensive Property Verification: Conduct thorough due diligence on property titles and potential legal encumbrances.

- Currency Hedging: Develop strategies to manage potential exchange rate fluctuations.

- Local Financial Expertise: Partner with professionals who specialize in Costa Rican real estate financing.

Investors must recognize that real estate loan risks are not insurmountable but require careful, strategic planning. Understanding local market nuances, maintaining financial flexibility, and working with experienced professionals can transform potential challenges into successful investment opportunities.

The Costa Rican real estate market continues to attract international investors, but success hinges on comprehensive risk assessment and strategic financial planning. Thorough preparation and expert guidance can help navigate the complex landscape of real estate loans in this dynamic Central American market.

To help compare the main loan requirements and risks for foreign investors, the table below summarizes key factors outlined in this section:

| Factor | Typical Range/Requirement | Key Risk for Foreign Investors |

|---|---|---|

| Down Payment | 35% – 50% of property value | High upfront capital requirement |

| Interest Rate | 7% – 12% | Higher cost vs. developed countries; affects returns |

| Currency Exchange | Costa Rican colón vs. home currency | Exchange rate volatility, fluctuating repayment amounts |

| Documentation Complexity | High | Potential title issues, historic discrepancies, legal hurdles |

| Legal Representation Needed | Always | Required to verify titles and minimize registration issues |

Market and Currency Risks for Foreign Investors

Foreign investors diving into Costa Rican real estate must understand the intricate landscape of market and currency risks that can significantly impact their investment strategies in 2025. These risks extend far beyond simple property valuation, encompassing complex economic and financial dynamics that demand strategic navigation.

Economic Volatility and Investment Vulnerability

The Costa Rican real estate market presents unique challenges characterized by economic unpredictability. Currency fluctuations represent a primary risk factor for international investors. The Costa Rican colón experiences substantial volatility, which means investment values can dramatically shift based on exchange rate movements. Investors might find their property’s perceived value changing rapidly without any underlying physical asset modifications.

Economic indicators suggest potential risks include sudden currency devaluation, which can erode investment returns. For instance, a 10% depreciation of the colón could effectively reduce an investor’s property value when converted back to their home currency. This volatility demands sophisticated financial planning and continuous market monitoring.

Strategic Risk Management Approaches

Successful foreign investors implement comprehensive risk mitigation strategies to protect their real estate investments. Hedging becomes crucial in managing currency exposure. Financial instruments like forward contracts and currency options allow investors to lock in exchange rates, providing a buffer against unexpected market shifts.

Diversification emerges as another critical risk management technique. learn about expat financing strategies that can help spread potential risks across multiple investment vehicles. Investors should consider maintaining a balanced portfolio that includes different property types and locations within Costa Rica to minimize potential economic vulnerabilities.

To clarify key risk management strategies discussed, here is a summary table of approaches for mitigating market and currency risks:

| Risk Factor | Example Mitigation Strategy |

|---|---|

| Currency Volatility | Currency hedging (forwards, options) |

| Market Downturns | Portfolio diversification |

| Economic Instability | Regular market monitoring, adaptive planning |

| Regulatory Shifts | Local legal advice, stay informed |

| Rental Income Fluctuations | Maintain financial reserves |

Comprehensive Investment Assessment

Thorough due diligence becomes paramount when evaluating real estate investments in Costa Rica. Investors must analyze multiple economic factors including:

- Local Market Trends: Comprehensive evaluation of regional property value trajectories

- Economic Stability: Assessment of national economic indicators and potential political risks

- Currency Performance: Detailed analysis of historical and projected currency exchange patterns

Beyond financial metrics, investors need to understand broader economic contexts. Costa Rica’s economic environment includes factors like tourism dependency, agricultural export performance, and international investment attractiveness. These elements directly influence real estate market dynamics and potential investment returns.

Understanding market and currency risks requires more than statistical analysis. Successful investors develop a nuanced perspective that combines rigorous financial assessment with deep cultural and economic insights. They recognize that real estate investment in Costa Rica is not merely a transaction but a complex interaction between global economic forces and local market conditions.

The most effective approach involves continuous learning, adaptive strategies, and partnerships with local financial experts who understand both international investment principles and Costa Rican market intricacies. Foreign investors who approach the market with patience, strategic thinking, and comprehensive risk management are best positioned to transform potential challenges into meaningful investment opportunities.

How Loan Terms Impact Passive Income Potential

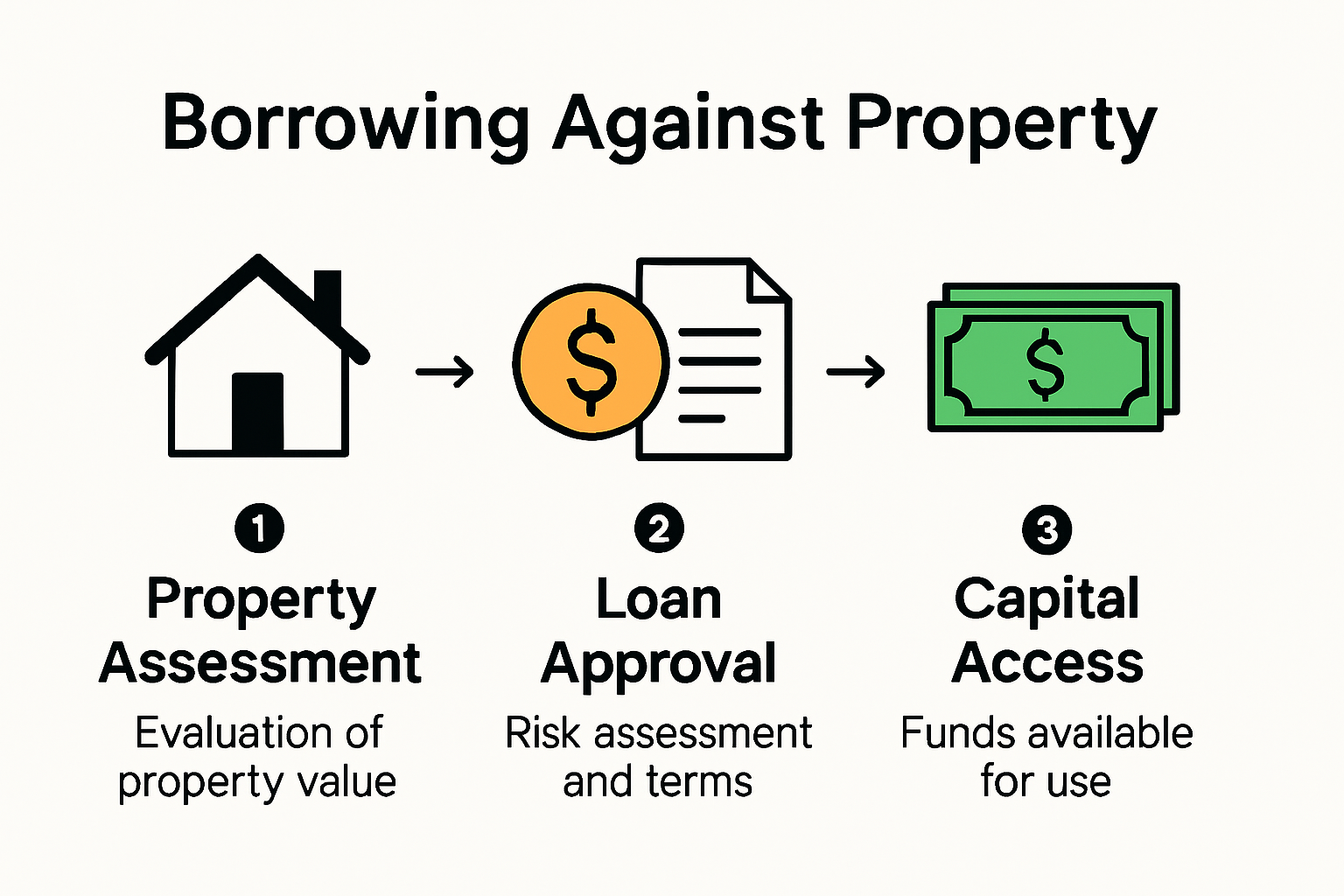

Passive income potential in real estate investments hinges critically on understanding and strategically selecting loan terms. Investors seeking to generate sustainable returns in Costa Rica must carefully analyze how different loan structures can significantly influence their financial outcomes.

Loan Duration and Income Dynamics

Loan terms directly affect an investor’s ability to generate passive income by determining cash flow, interest rates, and overall investment flexibility. Short-term loans typically ranging from 6 to 24 months offer rapid investment cycles but require more active management. These loans can provide higher potential returns through quick property turnovers or renovation projects.

Longer-term loans spanning 3 to 10 years present a more stable passive income strategy. These extended terms allow investors to benefit from consistent rental income while maintaining lower monthly payment obligations. The predictability of longer-term loans enables more accurate financial planning and reduces the risk of unexpected financial disruptions.

To help investors compare loan term options for passive income—summarizing details from the section above—the following table outlines key differences between short-term and long-term loans:

| Loan Type | Duration | Benefits | Drawbacks |

|---|---|---|---|

| Short-term Loan | 6–24 months | Quick turnarounds; potential high ROI | Higher active management needed |

| Long-term Loan | 3–10 years | Stable cash flow; lower payments | Less flexibility; higher total interest |

Interest Rates and Return Calculations

Interest rate structures play a pivotal role in determining passive income potential. Fixed-rate loans provide stability, allowing investors to accurately project future income streams. Variable-rate loans introduce potential volatility but might offer lower initial rates. Investors must carefully calculate the total cost of borrowing against potential rental income.

explore strategic financing approaches that can optimize your passive income potential. Understanding the relationship between loan terms and investment returns becomes crucial for making informed financial decisions.

Risk Mitigation and Income Optimization

Successful passive income generation requires a comprehensive approach to loan term management. Investors should consider multiple factors when selecting loan structures:

- Cash Flow Analysis: Detailed evaluation of potential rental income against loan repayment obligations

- Market Flexibility: Ability to adapt loan terms to changing market conditions

- Investment Goals: Alignment of loan terms with long-term financial objectives

The most effective investors view loan terms as dynamic tools for financial optimization. They recognize that passive income is not simply about securing a loan but about creating a strategic financial framework that maximizes returns while minimizing risks.

Costa Rican real estate offers unique opportunities for passive income generation, but success depends on sophisticated loan term management. Investors must develop a nuanced understanding of how different loan structures interact with local market conditions, rental dynamics, and broader economic trends.

Ultimately, passive income potential is not predetermined but carefully crafted. It requires a combination of strategic loan selection, thorough market research, and continuous financial adaptation. Investors who approach loan terms as a flexible strategic tool rather than a fixed constraint are best positioned to create sustainable passive income streams in the Costa Rican real estate market.

Smart Risk Management Strategies for Property Owners

Property owners in Costa Rica face a complex landscape of financial risks that demand sophisticated and proactive management strategies. Effective risk mitigation goes beyond simple insurance coverage, requiring a comprehensive approach that addresses multiple potential vulnerabilities in the real estate investment ecosystem.

Comprehensive Portfolio Diversification

Diversification emerges as a fundamental strategy for minimizing investment risks. Successful property owners understand that concentrating investments in a single property type or location creates significant exposure. By spreading investments across different property categories residential, commercial, and agricultural properties investors can create a more resilient financial portfolio.

Geographic diversification within Costa Rica becomes equally critical. Different regions experience varied economic dynamics, with coastal areas, urban centers, and agricultural zones presenting unique market characteristics. Investors who distribute their property holdings across multiple locations reduce the potential impact of localized economic downturns or regional market fluctuations.

Financial Protection and Risk Mitigation

Financial protection requires a multilayered approach that goes beyond traditional risk management techniques. discover comprehensive property investment protection to understand the nuanced strategies for safeguarding real estate investments. Currency hedging techniques play a crucial role in protecting international investors from exchange rate volatility.

Key financial protection strategies include:

- Comprehensive Insurance Coverage: Robust property and liability insurance that addresses multiple potential risks

- Currency Hedging Instruments: Forward contracts and options to manage foreign exchange exposure

- Emergency Financial Reserves: Maintaining liquid assets to manage unexpected property maintenance or market disruption costs

Legal and Regulatory Risk Management

Navigating the complex legal landscape of Costa Rican real estate requires meticulous attention to regulatory details. Property owners must develop a comprehensive understanding of local property laws, tax regulations, and investment restrictions. This involves maintaining updated documentation, working with local legal experts, and staying informed about potential regulatory changes.

Thorough due diligence becomes a critical risk management tool. This includes comprehensive property title searches, verification of existing encumbrances, and assessment of potential legal challenges. Investors should prioritize transparency and seek expert guidance to minimize legal vulnerabilities.

Smart risk management in Costa Rican real estate is not about eliminating all potential risks but about creating a strategic framework that effectively identifies, assesses, and mitigates potential challenges. Successful property owners develop a holistic approach that combines financial sophistication, legal expertise, and adaptive strategies.

The most effective risk management strategy recognizes that the real estate market is dynamic and constantly evolving. Investors must remain flexible, continuously educate themselves, and be prepared to adjust their approaches in response to changing market conditions. Those who view risk management as an ongoing process rather than a one-time exercise are best positioned to protect and grow their real estate investments in Costa Rica.

Frequently Asked Questions

What are the main risks associated with real estate loans for expats in Costa Rica?

The primary risks include currency exchange fluctuations, high down payment requirements, legal complexities in documentation, and elevated interest rates that can affect investment returns.

How can foreign investors mitigate currency risks when investing in Costa Rican real estate?

Foreign investors can mitigate currency risks by using financial instruments like forward contracts or options to lock in exchange rates, as well as maintaining a diversified investment portfolio to spread exposure.

What factors should expats consider when evaluating loan terms for real estate investments?

Expats should consider loan duration, interest rates, and their potential impact on cash flow. Understanding the balance between short-term and long-term loans can also help them optimize passive income potential.

Why is legal representation important for real estate transactions in Costa Rica?

Legal representation is crucial in Costa Rica to ensure proper verification of property titles, navigate complex documentation processes, and minimize risks associated with historical discrepancies and unresolved boundary issues.

Protect Your Investment Dreams in Costa Rica — Choose Private Lending with Confidence

Uncertain about the risks of real estate loans as an expat or investor? The article highlighted how currency swings, legal pitfalls, and strict requirements can stand between you and your property goals. You do not have to let volatile exchange rates or complicated documentation ruin your real estate plans. There is a smarter way to access the capital you need while maximizing security and transparency.

Unlock safe, flexible borrowing and enjoy full transparency with CostaRicaLoanExperts.net. Start by exploring our real estate secured loan solutions or check out proven expat financing strategies designed for your situation. Do not wait while the market moves. Connect now for expert support and see how easily you can protect your investment and grow your returns in Costa Rica.

Recommended

- Expat Financing Challenges: Overcoming Hurdles in 2025 – costaricaloanexperts.net

- Expat Property Financing in 2025: Smart Strategies and Tips – costaricaloanexperts.net

- expat financing challenges – costaricaloanexperts.net

- expat property financing – costaricaloanexperts.net

- Property-Backed Loans Explained: A 2025 Guide for Expats & Investors – costaricaloanexperts.net

- Private Lending Opportunities 2025: Smart Strategies for Expats & Investors – costaricaloanexperts.net